Welcome to another CryptoG newsletter!

What you can expect this week:

Elon Buys Twitter - A last minute change in my newsletter as breaking news came in that Twitter will change hands and Elon will be the new owner!

CRYPTOG Buy Zone Indicators Part II - Last week I have presented some easy ways to identify an ideal “Buy zone” for Bitcoin and this time as promised I will show you what I am looking for in on-chain data

Weekly Overview - J Powell did not disappoint at IMF last week, by that I mean he did move the markets that start to fall in line, slowly getting back down. Being too resilient will not pay off in long term, forcing FED’s hand in a way more aggressive tightening this year that should eventually melt down any defences left and give us low prices on both equities and crypto.

Elon Buys Twitter

As mentioned last week Elon Musk put an offer on the table of 44 billion $ and it was accepted today. This means he will take company private and a lot of changes could be on the cards. Freedom of speech is apparently his main goal, so you might see Mr Trump back and other figures banned by previous establishment.

DOGE holders will be high on “hopium” for next few weeks at least, after Elon’s success and we can see that immediately in today’s price action. Can this pump be sustainable? I doubt that as it will be a long road before any major changes can happen in Twitter and a long road for DOGE to be even remotely useful to anyone. While news is fresh I could see DOGE getting up to 20 cents, before markets positive reaction to the news (even Bitcoin and equities went up today) goes back to red.

CRYPTOG Buy Zone Indicators Part II

Continuing from last week today I would like to show you few on-chain metrics I am monitoring on daily basis to have a better understanding of where Bitcoin is and when it will enter the enigmatic “Buy Zone”. Before I go into the charts, little explanation on what on-chain data is. As Bitcoin and many other blockchains are public, all the raw data on it is public, transactions, wallet addresses, fees paid etc. allowing anyone to analyze and verify it. Thanks to the transparency and platforms like CryptoQuant that provide on-chain data in easy to digest format, traders can use the information there to their advantage.

STOCK TO FLOW REVERSION - You’ve already seen my S2F ratio analysis and if not I highly recommend it. Read more

This chart shows the relative difference between the market price and S2F ratio, indicating whether price is overvalued if above ‘1’ (areas colored in red). This is a quicker way of checking when it is worth buying Bitcoin for those hunting for real bargains and that do not have time for analyzing the actual S2F ratio chart. Link to chart

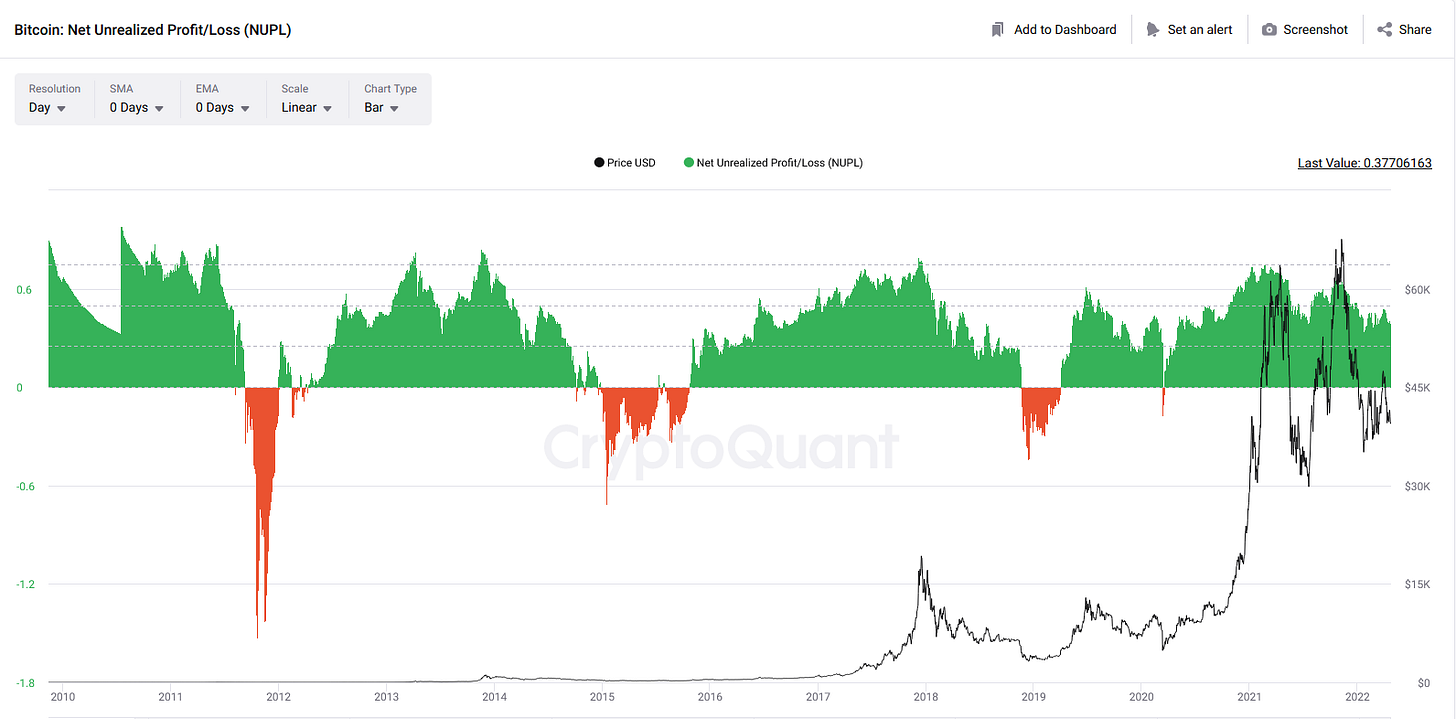

NET UNREALIZED PROFIT/LOSS - In simplest terms this represents the ratio of investors who are in profit (values above zero, green color) at a given time. Here “Buy Zone” is easily identifiable when chart turns red, especially effective when combined with traditional charts and methods described last week. Link to chart

You can see a steady decline over last few months and that we are still quite far away from going into red territory.

MVRV RATIO - This chart represents Bitcoin’s market cap ratio to its realized cap, indicating when it is over or undervalued. We are looking for MVRV value to drop under ‘1’ to identify our “Buy Zone” start. Link to chart

You can see that most of these align and that is a good thing, you should never trust one indicator or metric to make your investment/trading decisions.

I am sure many of you will find these simple methods useful for identifying best times to accumulate Bitcoin and in turn being able to estimate how close to the “mythical” bottom of the market we might be.

To finish I wanted to show one particular on-chain data that many “crypto influencers” refer to when trying to convince people that bull market is still on.

BITCOIN ACTIVE ADDRESSES - This purely shows how many unique active BTC addresses, inclusive of senders and receivers, exist on blockchain. Simply numbers going up are indicative of bullish momentum, sudden drops as you can see happen when Bitcoin is no longer trending up as seen in early 2018 and May/June 2021.

Couple of interesting things to notice here:

in 2021, we have barely exceeded the number of active addresses from 2018 top of bull market

despite a new ATH in November, number of addresses did not rise by much and been in continuous decline since November, how can anyone claim we will see 100k soon is beyond me if there has been clearly less activity on Bitcoin for a long time now

Weekly Overview

As mentioned in the intro, J Powell during his debate at IMF, made it clear 50pts rate hike is coming which can be clearly seen on the CME probability chart.

Some predict there might even be a surprise 75pts hike coming, though its more likely to be June than May, either way any more indication that we could get it and you will see stronger moves down on all risk-on assets.

This week should be quiet enough on the traditional markets news front, but we should see enough price action and volatility as usually it precedes the expected decisions made by FED’s.

I am expecting a lot of volatility especially on crypto market, BTC leverage chart has been recording all time highs in 2 days and such strong spikes brought bigger moves in the past. I can see a potential short term move up (maybe back up to 42k) followed by a strong push down as I predicted earlier this month towards 33-36k area. That of course is strongly reliant on equities market, but with fresh negativity in the air I see another red weekly candle on the likes of SP500 and Nasdaq coming.

In other news, if you think Covid went away, you are wrong. Snap lockdowns in Shanghai caused not only mayhem in the city itself with thousands of residents closed for weeks in their “compounds”, but also in the busiest container port in the world. While port itself remained opened, restrictions put in place meant 90% of truck drivers could not work which in turn will cause massive supply chain issues (like we did not have enough of that already :/)

Over 20% of marine traffic in China goes through that port, so better start ordering your Christmas shopping now if you want it to make to EU/US on time.

For fans of cyberpunk and technology in general, there are people already like Mr Paumen in Netherlands who has 32 implants, to augment their bodies. One of his latest additions was a contactless payment microchip, that functions exactly the same as the one in your credit/debit card and has been injected under his skin. I guess he does not have to worry about forgetting his wallet. Would you want a microchip in your hand? Read more.

Next week’s newsletter will come late on Monday as I will be traveling this weekend, but that at least will give me a chance to analyze early market moves closer to FED’s monetary policy meeting.