What you can learn from CryptoG this week:

Crypto Loans - How DeFi makes it easier for anyone to access funds anytime and on clearly defined terms

CRYPTOG Buy Zone Indicators Part I - Time to start sharing some of my key indicators and on-chain charts that I am monitoring to evaluate the best moment to buy during this bear cycle

Weekly Overview - Elon vs Twitter saga begins, JP’s double speech

Crypto Loans

Lending and borrowing have been a backbone of current centralize financial system we all know and part of most of our adult lives. Most of you have experienced many negative feelings that accompany either side of lending business, anger caused by rejection of your loan application, fear of missing payments, increased stress levels when your repayment amount goes higher, inability to get your money back from a “friend” that you lend money to, ruthlessness of banks and many other similar situations.

Luckily this is one of the many industries that blockchain technology can help fixing and any projects that deal with any aspects of finance fall into DeFi (Decentralized Finance) category. Read more

In short blockchain removes the need for intermediaries, banks, brokers, credit score etc. it lets two parties come to an agreement on clear terms through smart contracts. In case of loans, what is the sum you will borrow, what is the interest rate (usually showing a daily or hourly rate) and date to repay by. Decision is automatic and pretty much instant, no one will ask about your work references, bank payslips or how many kids you have, all you need is a collateral in a form of a digital asset that is accepted by the lender.

If you dig around you can find very cheap loans for long terms, but most are targeted at traders for short term lending up to 6 months. Either way options are there and it is a fast growing industry with many other finance instruments.

Another positive is that in most cases you do not repay anything until the end of term and sometimes only interest rates in agreed intervals, while not being penalized for early repayment. You always have a clear view from the start of the cost of your loan and outstanding amount that will not change no matter what any central bank in the world decides to do, like raising interest rates.

You might think by now, “Hey that sounds great, what is the catch?”, and yes you are right there is a risk to these loans.

In most cases you need to release your digital assets to be held in an equivalent of an escrow account, so you can’t do anything with those tokens/coins

There is a limit to how much money/crypto you can borrow against your collateral which is represented by Loan to Value ratio (LTV). Usually 40-65%

To ensure final repayment is made and collateral has sufficient value (for example using a volatile asset that can lose 50% value could mean that it is not enough to secure your loaned amount anymore) those contracts have an agreed liquidation price of your asset. I will show this in an example below.

Not all digital assets can be used as collateral, although that should not be a problem as general rule of thumb is to never use any of the smaller volatile crypto assets. Stick with BTC, ETH and stablecoins like USDC, BUSD

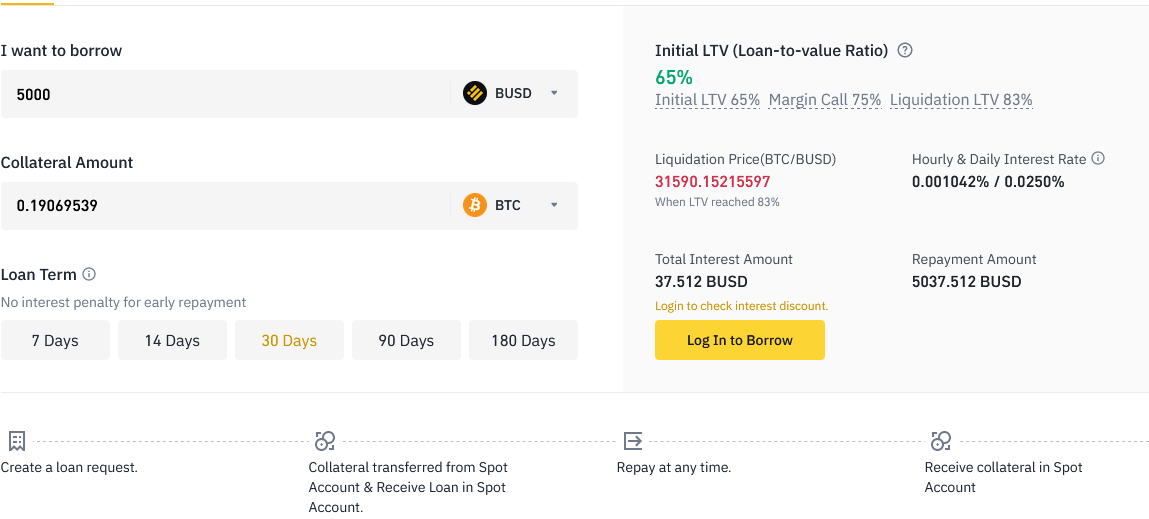

In the example below you want to borrow 5,000 BUSD, that at current roughly 40k$ price of BTC requires 0.19BTC as collateral to satisfy the maximum LTV of 65%. You can see all other terms, daily/hourly interest rate, how much this loan will cost you and most importantly Liquidation price for BTC/BUSD of 31,590, meaning when Bitcoin drops that low while loan remains unpaid it will be automatically sold to cover the loan.

That is why I would advise against taking max allowed LTV, best practice is to reduce LTV level to 30-50% after you started the loan by adding more collateral. This in turn will lower your liquidation price and risk of losing your assets.

Of course you will get an alert when BTC price will be closer to that level and you can set alerts on trading platforms or on exchanges.

Why would you take a crypto secured loan in first place? As mentioned earlier these are popular among traders in certain situations especially at market lows. You can leverage your current position for example in BTC, by taking a loan buy more BTC that if needed can be still used as collateral to either take another loan or lower LTV for the original one.

Using these loans for unexpected situations is very handy when you do not wish to sell your assets at that moment in time. Another reason is to prevent unnecessary taxable events as selling your crypto qualifies as one in most jurisdictions, while taking a secured loan on it and then repaying it is not.

Of course most of us would consider taking a loan, but DeFi platforms and in fact a lot of exchanges provide an option for you to be a lender and let your crypto earn while you know you don’t need to sell. It is not as profitable as Staking (I will cover staking next week), but for some altcoins lending them out is the only option for passive income.

It is good to be aware of these finance products availability as even if you plan to HODL, there will be times when you could need a quick loan without banks asking too many questions.

CRYPTOG Buy Zone Indicators - Part I

In this short series I will try to cover most if not all my setups to identify the ultimate bottom of bear cycle, what I refer to as “BUY ZONE”. It is always the most profitable entry before the next halving and in turn new full on bull cycle. While waiting for BUY ZONE isn’t suitable for everyone, as it requires a lot of patience and discipline, it is worth knowing few ways to identify it.

Two most powerful and simplest ways of catching the “BUY ZONE”, come from 200Weekly MA and RSI (11) closing below 30. Combining with “LazyBear” Wave oscillator (custom free indicator on TradingView platform) as confirmation for downtrend exhaustion gives you pretty much 99% probability that you are buying at lowest price range for Bitcoin

How does that look on a chart?

As you can see RSI on its own went below 30 earlier in 2014, which would not be the worst price to get some BTC, other indicators did not align yet suggesting some more patience was required. That is where Wave oscillator helps (you might find other common oscillators instead but I prefer this for crypto charts) identify the actual optimal "BUY ZONE”. While in that zone, you can set your Buy Limit Orders around 200WMA (the purple line) which got hit in early Jan 2015 at 194$. Even if you missed the start of it, you could have bought BTC cheap for more than 6 months as Bitcoin kept coming back to 200WMA. RSI going above 50 signifies Buy Zone end and probability of price coming back to 200WMA less likely.

Question is, did this happen again after 2017 bull run?

Yes it did and while the “BUY ZONE” did not last as long, it provided great opportunity for patient Bears. As soon as RSI and Wave oscillators hit the desired levels, you would have set LO’s around 200WMA, bagging cheapest Bitcoin during that bear cycle.

At that point no one could predict Covid and its impact on global economy in March 2020. Quite a dramatic drop happened on all risk-on markets including Bitcoin, RSI moved below 30 and price hit well below 200WMA, showing you that a cheeky LO at those levels is never a bad thing even if price seems to have escaped the worse of bear market already.

Where are we now?

If you followed my previous articles, you know we are following same bear market patterns as before, clearly on the way to 200WMA again and that final market meltdown. Depending on what happens around the world, decisions on QT and int rates in US we could see BTC go below 30s as soon as May, but I suspect the actual meeting with 200WMA (22-23k range) will not happen until 2nd half of 2022. How long this “BUY ZONE” will remain opened is impossible to tell, but I suspect it might be shorter than 2018, considering so many potential larger buyers are waiting in line for cheap Bitcoin.

Next week I will show you some of my Onchain charts that can give you further insight on when to invest your hard earned money in digital assets!!

Weekly Overview

This week would have been pretty dull if it was not for Elon Musk trying to take over Twitter in the name of free speech. Twitter HQ was in full panic mode after receiving 43b$ buyout offer that they rejected it apparently without consulting shareholders.

Twitter is mounting a so called “poison pill” defense, something all fans of Succession series should follow from now on ;) Read more.

Our usual suspect next week is J Powell, speaking not once but twice on Thursday, likely commenting on fresh CPI numbers (8.5% YoY inflation vs 8.4% expected), rising bond yields and most likely blaming everything on Russia. As always we can’t forget about Ukraine/Russia conflict, but it feels more and more likely to go on for a very long time with increasing pressure on energy and food prices.

The general direction as mentioned in previous weeks is still to the downside, BTC’s chart following my most likely prediction almost to the letter. Link to live chart feed.

In altcoins world, DOGE holders should follow new Twitter saga, as they will hope Elon would make it official Twitter currency at some point, if take over is successful and DOGE can overcome its current transaction processing inefficiencies.

If you have any questions or specific topics for me to write about, please drop a comment below and for all of you celebrating any holidays this weekend, I wish you some quality family time. Stay away from charts, I promise nothing will happen in the world of Crypto before Tuesday.