A lot of you might be familiar with “PlanB” and his Stock to Flow model for Bitcoin, you will also know that it failed to predict the market top, but that is common for most experts out there and I was not wiser at the time, as most did, expecting another pump in December, we know how that went.

What is Stock to Flow (S2F)

Bitcoin’s S2F Ratio is defined as a ratio of currently circulating coins divided by newly supplied coins and it assumes that the scarcity of BTC drives its price.

In short, it can help us find true value of Bitcoin and where price might go next. Keep on reading as I reveal how it clearly gave signals in 2021 at what price levels to exit and what BTC will be worth in 2024/25.

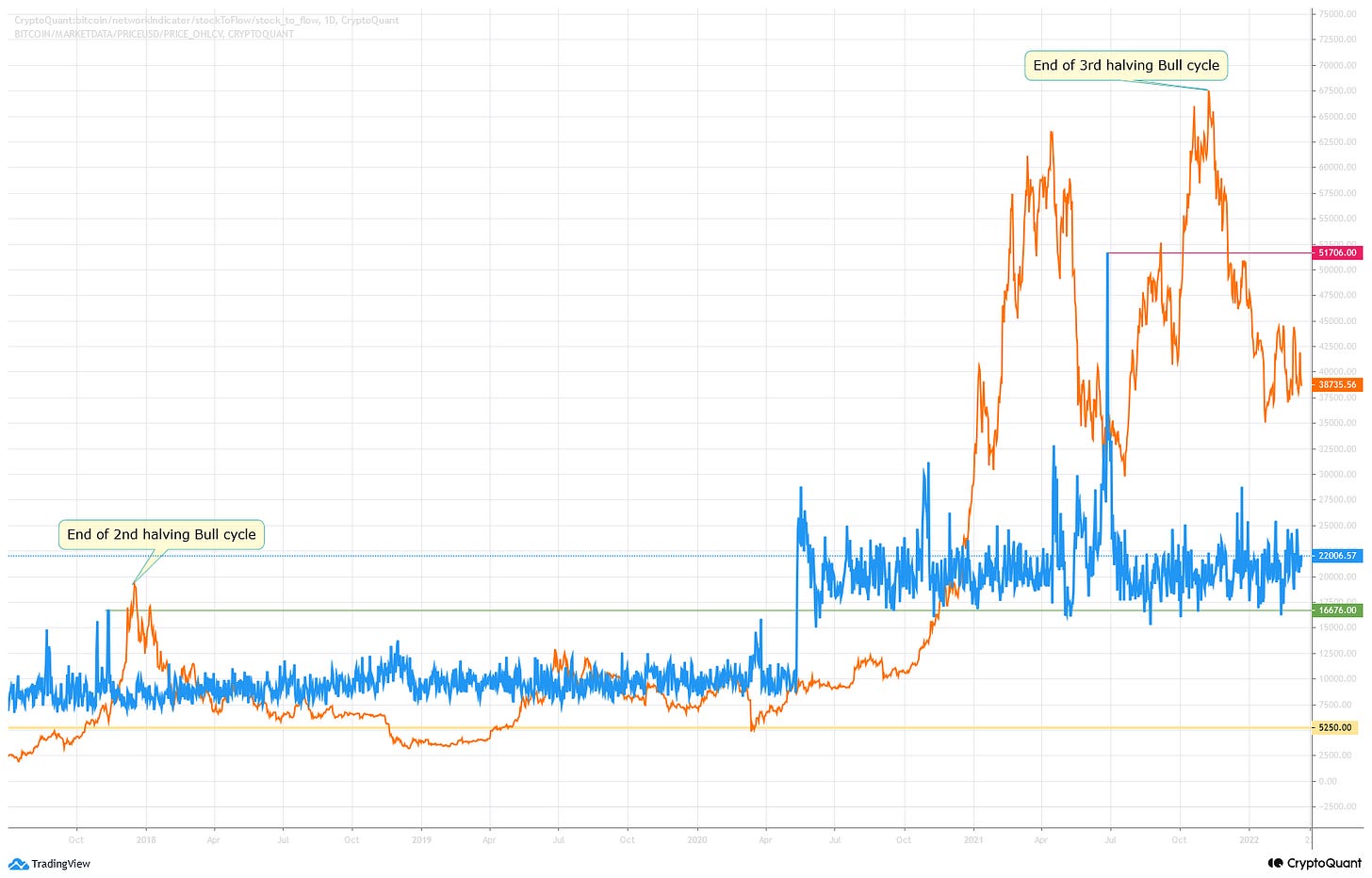

S2F ratio “jumps up” every halving (you can find more info on BTC Halving here) which can be clearly seen above. As the scale on this chart isn’t calibrated correctly I have created my own chart and it will serve as basis for my S2F Bitcoin Value model.

Early years

I am sure everyone would like to send a message to the past, telling yourself to buy Bitcoin, as it was a bargain even at the height of 2013 bull run. As you can see on the chart below, price stayed way below S2F targets hinting it was a great time to invest.

As you know each halving so far had a bull run shortly after the halving event, followed by a bear market. While 2013 top did not “catch up” with S2F price, it did hit the pre-halving levels.

2nd Bitcoin Halving

This is where things start to get interesting as first time since its inception BTC’s price hit above S2F ratio price levels in late 2017. Anyone who bought in 2016 or earlier was looking at 20x-80x+ returns. That is if they knew at what price level to sell.

Here is the amazing thing how S2F ratio could have helped you find the price range to sell all or some of your investment with a profit. Please notice the two S2F price levels marked in Yellow (5,250$), is the top of 1st halving and Dark green (16,676$) was the last spike and highest S2F price for 2nd halving.

Current halving spikes in S2F price indicate how high Bitcoin could go indicating a likely last chance buy opportunity as you will clearly see the same pattern in current halving and 2021 bull cycle. Most importantly it gives you a potential price level to start selling at and while its above.

If we take previous halving’s S2F high, so our Yellow line and multiply by 4 we get 21,000$ as the top for our target BTC price range.

S2F price in table above for 2nd halving top is our minimum price at which you would start selling and Max range is the price we could expect BTC can get close to in right conditions.

3rd Bitcoin halving

We now have an assumption that we can work with in following halving that occurred in early 2020. You will also notice that S2F price spikes making new highs happened few times before the final one in November 2017, that only means your price target range gets narrower and you can adjust your lowest Sell orders as this occur, but you know your Max range well in advance. I will present my Halving cycle model in separate thread in near future, as you would not be advised to sell your assets early on during a bull run.

Let’s look at 3rd halving, so current situation.

Notice first how Bitcoin’s price was drawn back to S2F average range then dropping below it for a prolonged time, that most know as crypto winter. What is more interesting is the fact it dropped below 5,250$ 1st halving’s top level. While anytime price was below the S2F blue range, it was a good value, but best time to buy was when BTC stayed under 5,250$.

We should expect BTC drawn to current S2F average range between 16,000$ and 25,000$, possibly even below 16,676$ for best Buy opportunities over the next 6-12 months.

Some could argue that current popularity of BTC among institutional investors is on the rise and there are a lot of buy orders already around 30k$ mark, but if you look at current macro and geopolitical situation and future outlook, there is little to be optimistic about and I am certain we did not have the full capitulation/sell off in crypto market yet.

Now let’s do same BTC exit price range calculations as we did for 2nd halving. On the chart current halving’s top is marked in Red at 51,706$ and again when it happened BTC’s price was below that indicating a last opportunity to accumulate before the final push higher.

The difference this time was that BTC hit 64,895$ (only 3% off the Max range) price in first Bull cycle phase in April and anyone following this model at the time would be wise to start taking profits when BTC gets within 10% off the Max range price.

If you bought at or below 5,250$ and exited at 60,000$ that is 11x+ your initial investment!!

S2F 3rd halving top happening in late June only gave everyone a 2nd chance to buy back at favourable prices and expect with high probability that BTC will hit over 60k$ again, and so it did. Bitcoin surpassed the Max range price in early November giving ample time for everyone to exit their positions gradually.

4th Bitcoin halving and how to prepare

Knowing that my S2F Bitcoin value model worked perfectly for both buying and selling levels by now, how can we profit with this powerful tool?

I will be referencing this model in my other publications and weekly newsletter whenever my other indicators flag potential good buy opportunities, but in general I am expecting for BTC to drop below 25,000$ at some point this year and there is a good chance as mentioned before, with current economic and geopolitical situation, below 16,676$.

As for what we should expect Bitcoin’s price will be in 4th halving’s Bull cycle, see below table.

4th halving top S2F price is an approximation based on past correlation between halvings.

Our target range to sell some or all of your BTC (depending on your overall strategy) most likely to occur in 2025 is between 160,288$ - 206,824$.

Even if you decide not to wait for current prices to go below 25k and buy around 30k that is still over 6x your investment. This is your opportunity to make a life changing decision or even just let you get some independence from “banksters” that will not protect your money against raging inflation.

If you have not already, please subscribe below and share this post.

The bear gave me a gut punch when I didn't take profits at 60s <LOL!> Time to stomach the drops and come out alive on the other side of the cycle.

Not many believed this was possible, but after we've hit 18k already, you can see many others suddenly calling for under 16k BTC. We are getting closer to that final capitulation, make sure you are ready to grab some Bitcoin once below 16k over the next few months.